-

» Excellent «Unparalleled expertise is the

» Excellent «Unparalleled expertise is the

foundation of solid legal advice.

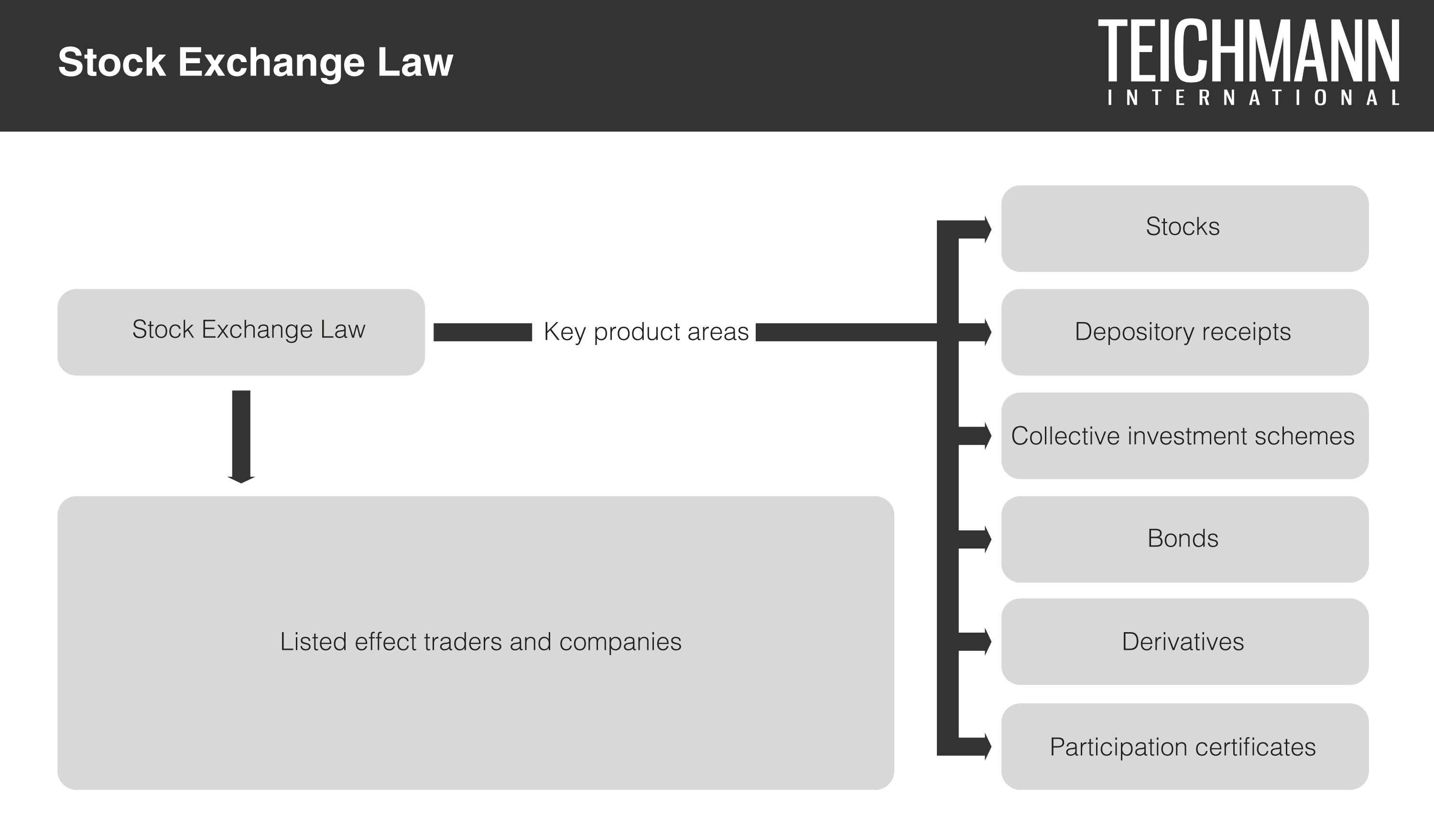

Stock exchange law regulates securities traders and companies listed on the Swiss stock exchange. These include, for example, issuers, banks, and investors. Relevant products include shares, including depositary receipts, collective investment schemes, bonds, derivatives, and participation certificates. In the context of stock exchange law, adherence to corporate governance and compliance aspects are also of great importance, for example in connection with sanction proceedings against stock exchanges.

In detail, there are various financial market legal foundations, whereby the Federal Act on Stock Exchanges and Securities Trading represents a uniform federal framework law. Among other things, this led to a radical deregulation of the financial market. The Financial Market Infrastructure Act regulates derivatives trading and financial market infrastructures. The Financial Market Infrastructure Ordinance then puts these into concrete terms. The Financial Infrastructure Ordinance is in turn substantiated by the Financial Infrastructure Ordinance-FINMA.

Furthermore, the Financial Institutions Act regulates the requirements for the activities of securities firms, asset managers, trustees, managers of collective assets and fund management companies. Among other things, it defines a licensing requirement for various forms of securities trading. Licensing and organizational requirements for supervised financial institutions are regulated by the Financial Institutions Ordinance.

In addition, the Capital Adequacy Ordinance stipulates that banks and securities firms must have adequate capital resources and limit risks in accordance with their business activities and risks. The Bank Insolvency Ordinance-FINMA specifies the restructuring and bankruptcy procedure of the Banking Act and applies to banks, securities firms, and mortgage bond institutions. Furthermore, the Takeover Ordinance defines how the transparency and fairness of public takeover offers as well as the equal treatment of investors must be ensured. Finally, there are also regulations of the Takeover Board.

We are happy to advise you on stock exchange law issues in connection with start-ups, for example financing via the capital market, as well as admission to trading on the regulated market and the third market. Furthermore, you can make use of our services in the context of stock exchange listings, compliance matters, takeovers, or representation before authorities such as the Swiss Financial Market Supervisory Authority. Due to our excellent education in the field of finance and our years of experience, we are able to offer you the best possible and individual solutions in all stock exchange law matters.