-

» Excellent «Unparalleled expertise is the

» Excellent «Unparalleled expertise is the

foundation of solid legal advice.

Banking law mainly regulates individual banking transactions and the credit industry. In general, banking law includes legal and regulatory aspects concerning bank accounts, payment transactions, mortgages, lending, asset management and more. International investment banking or trade finance transactions also fall within the scope of banking law. Furthermore, services such as family offices or e-banking are regulated by banking law if they are offered by a bank. Compliance also plays an important role in the context of banking law.

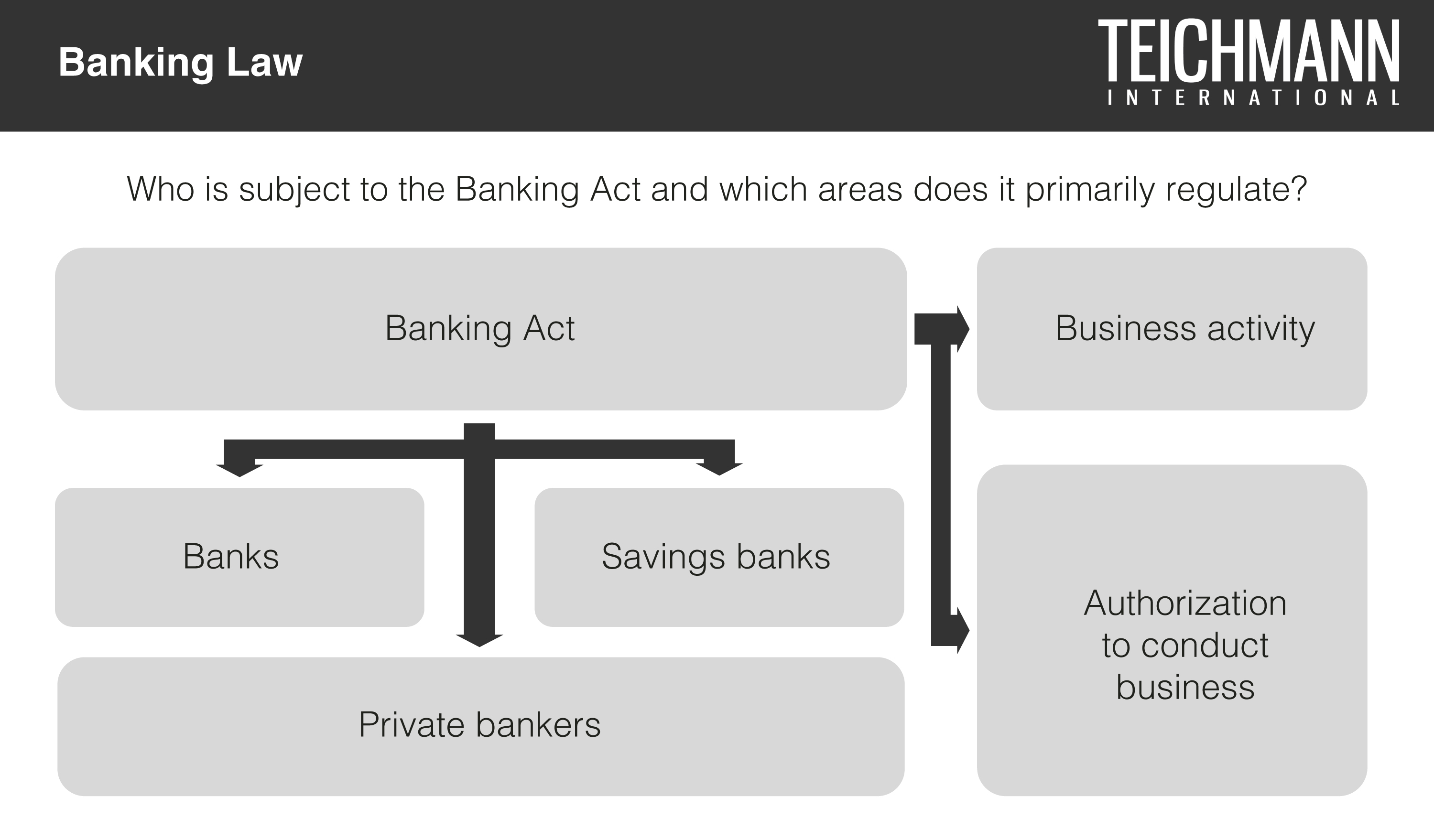

Banks, savings banks, and private bankers are subject to the Banking Act. Among other things, it regulates business activities and the authorization to conduct business. The Banking Act is substantiated by the Banking Ordinance, which also applies to banks, savings banks, and private bankers. Foreign banks wishing to establish themselves in Switzerland must comply with the Foreign Banks Ordinance of the Swiss Financial Market Supervisory Authority (FINMA).

Furthermore, the Capital Adequacy Ordinance regulates banks and securities dealers. Its aim is to protect the stability and creditors of the financial system. The Capital Adequacy Ordinance states that banks and securities dealers must have sufficient capital to limit their risks. The Liquidity Ordinance then defines qualitative and quantitative liquidity requirements for banks.

In addition, there are the Bank Insolvency Ordinance and the Accounting Ordinance. The first specifies the restructuring and bankruptcy procedure of the Banking Act and applies to banks, securities dealers, and mortgage bond centers. The second regulates the preparation of financial statements and the publication of annual reports and interim financial statements.

Our law firm has outstanding expertise in banking law. In all banking law matters, we always choose an interdisciplinary approach, as our expertise extends to legal as well as economic subject areas. In particular, our work in compliance has a long tradition. Our owner, attorney-at-law Dr. Dr. Fabian Teichmann, LL.M. holds degrees in economics, accounting and finance as well as general management, among others. In particular, he has a doctorate in the areas of circumvention of anti-money laundering measures and bribery prevention. We are happy to assist your company in the development and implementation of a suitable compliance strategy, but also as experienced legal representation in compliance investigations.